Will Synchrony Bank sue me? This question arises when facing financial difficulties or disputes with the bank. Understanding the circumstances surrounding potential legal action is crucial. This article explores the various scenarios where Synchrony Bank might consider legal action, the grounds for a lawsuit, potential defenses, and the impact of a lawsuit on both parties.

Potential triggers for legal action might include missed payments, fraudulent activity, or violations of the terms of service. Late fees, interest charges, and other financial penalties can also be factors in a potential lawsuit. This comprehensive guide will help you understand your rights and responsibilities in such a situation.

Understanding the Circumstances of Potential Legal Action

Synchrony Bank, a major provider of credit and financing products, may initiate legal proceedings against customers under specific circumstances. These situations typically involve a breach of contract or agreement, often stemming from a customer’s failure to meet their financial obligations. Understanding these circumstances is crucial for customers to avoid potential legal issues and manage their accounts responsibly.

Scenarios for Legal Action by Synchrony Bank

Synchrony Bank might initiate legal action when a customer violates the terms of their agreement. This can manifest in various ways, ranging from missed payments to fraudulent activities. The specific actions or inaction triggering a lawsuit are dependent on the nature of the agreement and the bank’s internal policies.

Types of Contracts and Agreements

Synchrony Bank enters into various contracts with customers, each with its own set of terms and conditions. These contracts typically Artikel the customer’s obligations, such as timely payments, adherence to usage policies, and reporting of any changes in personal information. Breach of these agreements, whether intentional or unintentional, can lead to legal repercussions. Examples of these agreements include credit card agreements, loan agreements, and retail financing contracts.

These agreements define the specific rights and responsibilities of both the bank and the customer.

Potential Reasons for Dispute

Missed payments are a common reason for disputes. Failure to make timely payments, coupled with ignoring notices from Synchrony Bank, can escalate the situation to a formal debt collection process, potentially leading to a lawsuit. Fraudulent activity, such as unauthorized charges or identity theft, also triggers legal action. Violations of the terms of service, such as exceeding credit limits or using the account for unauthorized purposes, can also initiate legal proceedings.

Role of Financial Penalties

Late fees, interest charges, and other financial penalties are integral components of Synchrony Bank’s agreements. These penalties are often clearly Artikeld in the terms and conditions of the contract. Accumulation of these penalties can significantly increase the outstanding balance, potentially escalating the situation to a legal dispute if not addressed promptly. Failure to pay these penalties, along with the underlying debt, can result in further action from the bank.

Table of Financial Issues and Potential Actions

| Financial Issue | Potential Synchrony Bank Actions | Possible Legal Action |

|---|---|---|

| Missed Payments | Sending notices, escalating to collections, potential account closure | Lawsuit for debt collection, garnishment of wages (in severe cases) |

| Fraudulent Activity | Suspending accounts, reporting to authorities, initiating fraud investigation | Lawsuit for damages, recovery of losses |

| Unauthorized Transactions | Investigating transactions, informing the customer | Lawsuit for recovery of unauthorized charges |

| Violation of Terms of Service | Issuing warnings, account restrictions, termination of services | Lawsuit for breach of contract |

Examining the Grounds for a Lawsuit

Synchrony Bank, a significant player in consumer credit, possesses the legal authority to initiate lawsuits against customers for various breaches of contract or other violations. Understanding the specific grounds for such actions is crucial for both consumers and the bank. This analysis delves into the legal precedents, requirements, and potential evidence used in these disputes.The legal framework governing Synchrony Bank’s right to sue a customer is rooted in contract law.

Well, regarding Synchrony Bank potentially suing you, it’s a bit complex. Finding the right income-based apartments in Huntersville, NC, like these ones , might help in understanding your financial situation better. So, it’s best to thoroughly review your Synchrony Bank agreement and see if there’s any clarity on their policies. Semoga semuanya baik-baik saja.

This framework emphasizes the importance of clearly defined agreements and the consequences of breaching those terms. A successful lawsuit requires Synchrony Bank to demonstrate a valid contract, a breach of that contract by the customer, and damages resulting from that breach. This involves demonstrating the specific terms of the agreement, the customer’s actions that constitute a breach, and the quantifiable financial impact of the breach.

Legal Precedents and Principles, Will synchrony bank sue me

Synchrony Bank, like other financial institutions, relies on established legal precedents and principles to justify its actions in court. These precedents typically involve the interpretation of consumer loan agreements, the establishment of liability for missed payments, and the calculation of damages. Cases involving similar contracts, particularly those involving credit card or installment loan agreements, often serve as a basis for determining the bank’s rights and the customer’s obligations.

Specific Legal Requirements for a Successful Lawsuit

For a lawsuit to succeed, Synchrony Bank must meet specific legal requirements. These requirements typically include demonstrating the existence of a valid contract, the customer’s violation of the contract’s terms, and the demonstrable harm (financial damages) resulting from that violation. Proof of the contract’s terms, the customer’s actions, and the consequential damages are crucial elements in establishing a legally sound case.

Types of Evidence in a Synchrony Bank Lawsuit

The bank would likely use various types of evidence in a lawsuit. These could include:

- Contract documents: The original loan agreement, credit card application, and any amendments or supplementary agreements.

- Payment history: Records of payments made, missed payments, and late fees.

- Account statements: Detailed statements outlining the account balance, interest charges, and any other relevant financial transactions.

- Correspondence: Letters, emails, and other communications between the bank and the customer regarding the account.

- Expert testimony: From financial professionals, to verify the accuracy of calculations related to interest, fees, and damages.

These documents are crucial for establishing the validity of the contract, the customer’s payment history, and the resulting damages.

Potential Legal Arguments

Synchrony Bank’s legal arguments would likely center on the customer’s failure to meet the terms of the agreement. Specific arguments could include:

- Failure to make required payments: Demonstrating that the customer consistently missed payments and accumulated outstanding balances.

- Violation of specific terms: Highlighting instances where the customer breached the terms of the agreement, such as exceeding credit limits or making unauthorized charges.

- Evidence of damages: Quantifying the losses incurred by the bank due to the customer’s failure to fulfill their obligations, such as late fees, interest charges, and collection costs.

These arguments aim to establish the customer’s responsibility for the financial consequences resulting from their actions.

Customer vs. Bank Perspectives in a Dispute

| Customer Perspective | Synchrony Bank Perspective |

|---|---|

| Misunderstanding of terms or errors in billing statements. | Clear and unambiguous terms of the agreement were violated by the customer. |

| Unjustified or excessive fees and interest charges. | Fees and interest are compliant with the terms of the agreement and applicable regulations. |

| Unfair or predatory lending practices. | Actions are consistent with industry standards and applicable regulations. |

This table highlights the contrasting viewpoints in a potential legal dispute. The customer may argue for misunderstandings or unfair practices, while Synchrony Bank will likely assert adherence to contractual terms and regulations.

Analyzing Potential Defenses

Synchrony Bank, like any creditor, carries the burden of proving its case in a lawsuit. Conversely, a customer facing such a claim has the opportunity to present defenses that might mitigate or completely negate the bank’s allegations. These defenses can encompass various legal strategies, from challenging the validity of the contract to demonstrating extenuating circumstances. Understanding these potential defenses is crucial for both sides in navigating the legal process.Analyzing the potential defenses a customer might raise against Synchrony Bank’s lawsuit involves a thorough examination of the alleged violations and the circumstances surrounding the debt.

This includes scrutinizing the contract terms, evaluating the customer’s financial situation, and exploring any external factors that may have contributed to the missed payments or other alleged violations. The strength and weaknesses of each defense depend heavily on the specific facts of the case.

Missed Payments Defenses

A common ground for a Synchrony Bank lawsuit involves missed payments. Defendants might argue that the terms of the agreement were unfair or misleading, potentially leading to a misunderstanding of the repayment obligations. Furthermore, unforeseen circumstances, such as job loss, significant medical expenses, or natural disasters, could constitute a valid defense, demonstrating that the missed payments were not due to negligence or willful default.

Evidence supporting these circumstances, such as documentation of job loss, medical bills, or official disaster declarations, is crucial. These mitigating factors could influence a judge or jury to view the situation with more empathy and potentially reduce the damages sought by the bank.

Unfair or Misleading Terms

Customers might argue that the contract terms were unfair or misleading. This defense hinges on demonstrating that the agreement contained hidden fees, excessive interest rates, or unclear repayment schedules that significantly impacted the customer’s ability to meet their obligations. This argument often involves presenting evidence such as detailed copies of the contract, financial statements, and potentially expert testimony to demonstrate the unfairness or misrepresentation of the agreement.

The strength of this defense rests on the clarity and persuasiveness of the presented evidence.

Unforeseen Circumstances

Customers might assert that unforeseen circumstances beyond their control caused the missed payments. Examples include job loss, significant medical expenses, or major life events that significantly impacted their financial stability. Demonstrating the validity and severity of these circumstances is key to this defense. Documentation such as layoff notices, medical bills, or supporting evidence of life-altering events can strengthen this argument.

The degree to which these circumstances negatively impacted the customer’s ability to make payments is critical in evaluating the strength of this defense.

Table of Potential Defenses

| Alleged Violation | Potential Defenses |

|---|---|

| Missed payments | Unfair or misleading terms, unforeseen circumstances, errors in billing, fraudulent activity |

| Default | Unfair or misleading terms, unforeseen circumstances, duress or coercion, inadequate notice of default |

| Failure to repay | Unfair or misleading terms, unforeseen circumstances, payment errors, fraudulent activity, contractual disputes |

Illustrating the Potential Impact of a Lawsuit

A lawsuit against Synchrony Bank, like any legal action, carries significant potential consequences for both the customer and the financial institution. Understanding these potential impacts is crucial for navigating such a situation responsibly. The financial and reputational ramifications can be substantial, and the legal process itself is complex and time-consuming.

Potential Financial Consequences for the Customer

The financial repercussions for the customer can range from substantial legal fees to potential damages awarded to the bank. These fees can be substantial and impact the customer’s budget significantly. Furthermore, the customer may have to invest considerable time and effort in preparing for and participating in the legal proceedings. The outcome could lead to the customer having to pay monetary compensation to the bank, or even face additional financial penalties.

Potential Reputational Consequences for the Customer

A lawsuit against a financial institution can have serious reputational consequences for the customer. Negative publicity surrounding the legal action can damage their personal or professional reputation. Public disclosure of the details of the case might negatively affect their future financial dealings or business prospects. The negative impact could linger even after the case is resolved, affecting future creditworthiness.

Potential Financial Consequences for Synchrony Bank

A lawsuit can strain Synchrony Bank’s resources significantly. The bank must allocate considerable time and resources for legal representation and defense. The cost of litigation, including legal fees, expert witnesses, and court costs, can be substantial. A negative judgment could lead to financial penalties and damage the bank’s reputation. Additionally, a prolonged legal battle can disrupt the bank’s operations and potentially impact its profitability.

Potential Reputational Consequences for Synchrony Bank

A lawsuit can severely impact Synchrony Bank’s reputation. Negative publicity associated with the case can damage the bank’s brand image and consumer trust. A protracted legal battle can cast a shadow on the bank’s trustworthiness and financial stability, leading to a loss of market share. The case details, if widely publicized, can affect the bank’s standing in the industry and investor confidence.

The Legal Process of a Lawsuit

The legal process of a lawsuit involves several stages, from the initial complaint to the final judgment. The specific steps vary depending on the jurisdiction and the nature of the case. A typical process includes the filing of a complaint, response by the defendant, discovery phase (gathering evidence), motions, trial (if necessary), and judgment. The length of the process can vary significantly, from a few months to several years.

Possible Outcomes of a Lawsuit

The outcome of a lawsuit can be a favorable judgment for either the customer or the bank, or a settlement agreement. A favorable judgment for the customer could involve the bank being ordered to compensate the customer for damages. Conversely, a favorable judgment for the bank could result in the customer being held responsible for costs and damages.

Nah, jangan khawatir tentang Synchrony Bank mau menggugat kamu. Kalau kamu lagi cari mobil baru, ada Honda CR-V Sport Touring Hybrid 2024 yang menarik nih buat dipertimbangkan 2024 honda crv sport touring hybrid for sale. Pasti ada banyak pilihan menarik dan sesuai budget, jadi tenang saja ya. Semoga masalah dengan Synchrony Bank bisa segera terselesaikan dengan baik.

Settlement agreements are often reached to avoid the protracted and costly legal process.

Resolving Disputes Outside of Court

Dispute resolution outside of court can be an effective way to address disagreements. Mediation and arbitration are common alternative dispute resolution (ADR) methods. These methods involve a neutral third party to facilitate communication and negotiation between the parties, potentially leading to a mutually agreeable solution. This approach is often quicker and less expensive than traditional litigation.

Illustrative Example of a Similar Lawsuit

A previous case involved a customer alleging improper handling of a financial transaction. The customer claimed that the financial institution failed to adequately explain the terms and conditions of a loan agreement. The case went through the initial stages of litigation, including the discovery phase and motions. Ultimately, the case was settled out of court, with both parties agreeing to a mutually beneficial resolution.

The specific terms of the settlement were confidential.

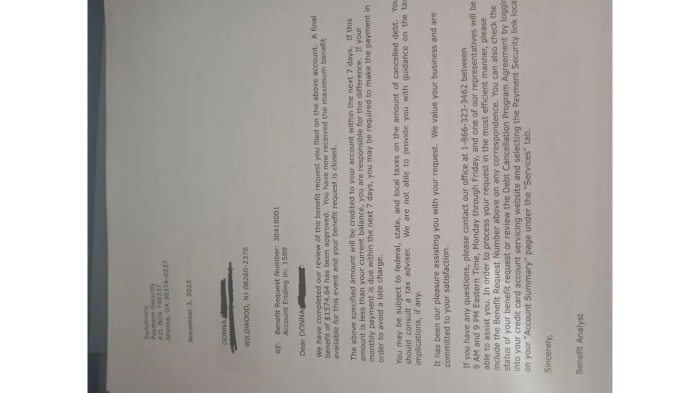

Steps to Take if Facing a Lawsuit: Will Synchrony Bank Sue Me

Facing a lawsuit from Synchrony Bank, or any financial institution, can be a daunting experience. Understanding your rights and responsibilities, and taking proactive steps, is crucial. This section Artikels the essential steps to navigate such a situation effectively.A notice of legal action from Synchrony Bank signifies a formal claim. The customer must immediately assess the situation and understand the potential consequences.

This involves careful review of the documents, and understanding the specific allegations.

Immediate Actions Upon Receipt of Legal Notice

Understanding the nature of the legal notice is paramount. Review the specific allegations carefully. Identify the legal basis for the claim, and determine if any deadlines are imposed for response. Failure to respond within the specified timeframe could have severe repercussions.

Seeking Legal Counsel

Seeking legal counsel is highly recommended. An attorney specializing in consumer law can provide crucial guidance tailored to your specific circumstances. An attorney can interpret complex legal documents, assess the strengths and weaknesses of the case, and advise on the best course of action. A lawyer familiar with Synchrony Bank’s practices can be especially helpful.

Questions to Ask Your Attorney

An attorney should be questioned regarding the specifics of the case. Key questions to ask include: What are the specific claims made by Synchrony Bank? What is the potential impact of not responding to the lawsuit? What are the potential defenses available? What is the best strategy to mitigate potential damages?

What is the expected timeline for the legal proceedings?

Gathering Relevant Documents and Evidence

Gathering all relevant documents and evidence is critical. This includes contracts, correspondence, transaction records, and any supporting documentation that might help your defense. The more comprehensive the evidence, the stronger your position. Organize these documents chronologically and systematically.

Responding to the Lawsuit

Responding to a lawsuit necessitates adherence to legal procedures. This includes filing a formal response within the stipulated timeframe, outlining your defenses and presenting evidence. Failure to respond appropriately could result in a default judgment against you. A lawyer will guide you through this complex process. Understanding your rights and responsibilities, and the relevant laws, is essential.

Final Summary

Navigating a potential lawsuit from Synchrony Bank requires careful consideration and a thorough understanding of the legal process. Seeking legal counsel is strongly recommended if you’re facing such a situation. Remember that taking proactive steps, like understanding the terms of your agreement and maintaining open communication with the bank, can significantly mitigate the risk of legal action. By arming yourself with knowledge and seeking professional guidance, you can better manage the situation and protect your interests.

Questions Often Asked

Can Synchrony Bank sue me for missed payments?

Yes, if missed payments are substantial and violate the terms of your agreement.

What evidence might Synchrony Bank use in a lawsuit?

Bank records, contracts, and communications between you and the bank are common forms of evidence.

What are common defenses against a Synchrony Bank lawsuit?

Arguments like unfair contract terms, unforeseen circumstances, or errors in the bank’s records could be potential defenses.

How can I resolve a dispute with Synchrony Bank outside of court?

Negotiation and mediation are often viable options before resorting to a lawsuit.